"Even setting aside big upfront expenses like a down payment, rising month-by-month costs are likely keeping many people from purchasing," said Danielle Hale, chief economist at realtor.com®. "Today only 41 percent of people live in a county where the median income family can afford to buy a home at the median list price, and affordability declined significantly over the past year. Since home ownership has historically been an important source of household wealth creation, it could be problematic if this trend continues for too long. Still, even in places where renting is currently more affordable, rising home prices provide wealth building opportunity for home buyers."

Analysis Highlights

Analysis Highlights

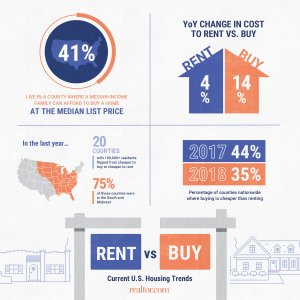

- Only 41 percent of the nation's population lives in a county where a median-income family can afford to buy a home.

- Nationally, the cost to buy rose by 14 percent from July 2017 to July 2018, while the cost to rent increased by 4 percent.

- In July, buying a home was cheaper than renting in 35 percent of counties, compared to 44 percent of counties last year.

- The top five counties where purchasing a home was more affordable than renting last month were: Clayton County, Ga.; Baltimore City, Md.; Wayne County, Mich.; Cumberland County, N.C.; and Madison County, Ill., with the share of income to buy being 4 percent to 14 percent lower than the share of income to rent.

- Renting remains much less expensive than buying in Manhattan, N.Y.; Brooklyn, N.Y.; Monterey County, Calif.; San Mateo County, Calif.; and Santa Barbara County, Calif.

- In the last year, 20 counties with 100,000+ residents flipped from being cheaper to buy to being cheaper to rent, three quarters of which were in the South and Midwest.

Home Affordability Has Declined Over Past Year

Homeowner costs have continued to rise. In July 2018, the median monthly cost to buy a home was $1,647, compared to the average cost to rent a home at $1,267. Over the last year, 289 counties have transitioned from being more affordable to buy, to being more affordable to rent. The transition included 20 larger counties with more than 100,000 of which eight counties were in the South and seven counties in the Midwest. In just 35 percent of counties throughout the country, the monthly costs of buying a home are now lower than the monthly costs to rent a home – this compared to 44 percent just last year. This disparity is even greater among large counties. Buying is still cheaper than renting for only seven percent of counties in the U.S. with a population larger than 100,000 people.

Homeownership Likely to Decrease in Rental Markets

The price of entry into homeownership is becoming steeper in markets around the country. Using data from the REALTORS® Affordability Distribution Curve, the July study revealed that in the top 5 rental markets those earning the median county income could only afford up to 4 percent of their local housing market inventory. Homeownership rates in these markets ranged between 23 to 59 percent, compared to the national rate of 64 percent.

Conversely, for the top 5 counties that favor buying, 57 to 69 percent of homes currently available for sale are affordable to residents earning the local median income while homeownership rates ranged from 47 to 63 percent. The limited availability of homes affordable for the median household in top rental markets suggests that renters will continue to find it challenging to become owners in these areas. At the same time, the larger selection of affordable homes available to the typical income household in the top buying counties suggest that transitioning from renting to owning will be easier in these areas.

Northern California Has Widest – and Fastest Growing – Gap Between Ability to Rent and Buy

Northern California and New York each hold three of the top 20 counties with the largest increase in the rent-versus-buy gap over the past year (comparing the share of income necessary to do each). The gap for counties in California was the largest in large part due to the substantial run-up in home prices experienced there. In San Mateo, Santa Clara, and San Francisco counties, the costs to purchase a home now take up an additional 8 percent of income over renting when compared to last year. In San Mateo, for instance, it costs $8,405 to buy compared to $3,471 to rent.

For more information about this analysis, please visit: https://www.realtor.com/research/july-2018-rent-vs-buy-report-home-prices-rise-three-times-faster-than-rents

Top 5 Counties Favoring Buying

|

Rank |

County |

Monthly |

Monthly |

Percent |

Percent |

2018 |

% of Inventory |

|

1 |

Clayton |

$699 |

$1,236 |

18% |

32% |

57% |

68% |

|

2 |

Baltimore |

$1,097 |

$1,475 |

27% |

36% |

47% |

57% |

|

3 |

Wayne |

$695 |

$1,040 |

18% |

27% |

65% |

63% |

|

4 |

Cumberland |

$864 |

$1,012 |

23% |

27% |

56% |

58% |

|

5 |

Madison |

$832 |

$1,019 |

17% |

21% |

73% |

69% |

Top 5 Counties Favoring Renting

|

Rank |

County |

Monthly |

Monthly |

Percent |

Percent |

2018 |

% of |

|

1 |

New York |

$9,840 |

$2,086 |

141% |

30% |

23% |

1% |

|

2 |

Kings |

$4,860 |

$2,086 |

102% |

44% |

27% |

3% |

|

3 |

Monterey |

$4,816 |

$1,682 |

85% |

30% |

51% |

0% |

|

4 |

San Mateo |

$8,405 |

$3,471 |

89% |

37% |

59% |

4% |

|

5 |

Santa |

$4,878 |

$1,910 |

81% |

32% |

53% |

3% |

20 Counties Where Renting Became Preferential to Buying in Past Year (Population 100,000+)

|

Name |

Metro Area |

Monthly Cost to |

Monthly Cost to |

|

Marion County, Ind. |

Indianapolis-Carmel-Anderson, Ind. |

$1,108 |

$976 |

|

Bronx County, N.Y. |

New York-Newark-Jersey City, N.Y.-N.J.-Pa. |

$2,147 |

$2,086 |

|

Richland County, S.C. |

Columbia, S.C. |

$1,111 |

$1,052 |

|

Jackson County, Mo. |

Kansas City, Mo.-Kan. |

$1,163 |

$998 |

|

Stark County, Ohio |

Canton-Massillon, Ohio |

$842 |

$766 |

|

Caddo Parish, La. |

Shreveport-Bossier City, LA |

$942 |

$942 |

|

Pulaski County, Ark. |

Little Rock-North Little Rock-Conway, Ark. |

$1,061 |

$945 |

|

Shelby County, Tenn. |

Memphis, Tenn.-Miss.-Ark. |

$1,064 |

$986 |

|

Lexington County, S.C. |

Columbia, S.C. |

$1,167 |

$1,052 |

|

Jefferson County, Ala. |

Birmingham-Hoover, Ala. |

$1,125 |

$1,047 |

|

Winnebago County, Ill. |

Rockford, Ill. |

$886 |

$861 |

|

Atlantic County, N.J. |

Atlantic City-Hammonton, N.J. |

$1,495 |

$1,483 |

|

Lorain County, Ohio |

Cleveland-Elyria, Ohio |

$971 |

$871 |

|

Cuyahoga County, Ohio |

Cleveland-Elyria, Ohio |

$928 |

$871 |

|

New Castle County, Del. |

Philadelphia-Camden-Wilmington, Pa.-N.J.-Del.-Md. |

$1,398 |

$1,314 |

|

Lake County, Ind. |

Chicago-Naperville-Elgin, Ill.-Ind.-Wis. |

$1,047 |

$984 |

|

Erie County, Pa. |

Erie, Pa. |

$882 |

$839 |

|

Horry County, S.C. |

Myrtle Beach-Conway-North Myrtle Beach, S.C.-N.C. |

$1,127 |

$1,093 |

|

Pinal County, Ariz. |

Phoenix-Mesa-Scottsdale, Ariz. |

$1,253 |

$1,214 |

Methodology

Purchase and rent costs reflect current costs and do not take into account holding period, price and rent appreciation, and inflation. Purchase costs do include taxes and insurance, and are calculated based on realtor.com county-level residential listing price data and mortgage rate data for July 2018. Rental prices are from the U.S. Department of Housing and Urban Development (HUD) data for 2018 50th-percentile rent estimates. Household income data and homeownership data is from Census Housing Vacancies and Homeownership data and 2018 Nielsen estimates based on Census data. Only counties with populations of 100,000 or greater are included in the top lists in this analysis.